WHY INVESTMENT IN APARTMENTS?

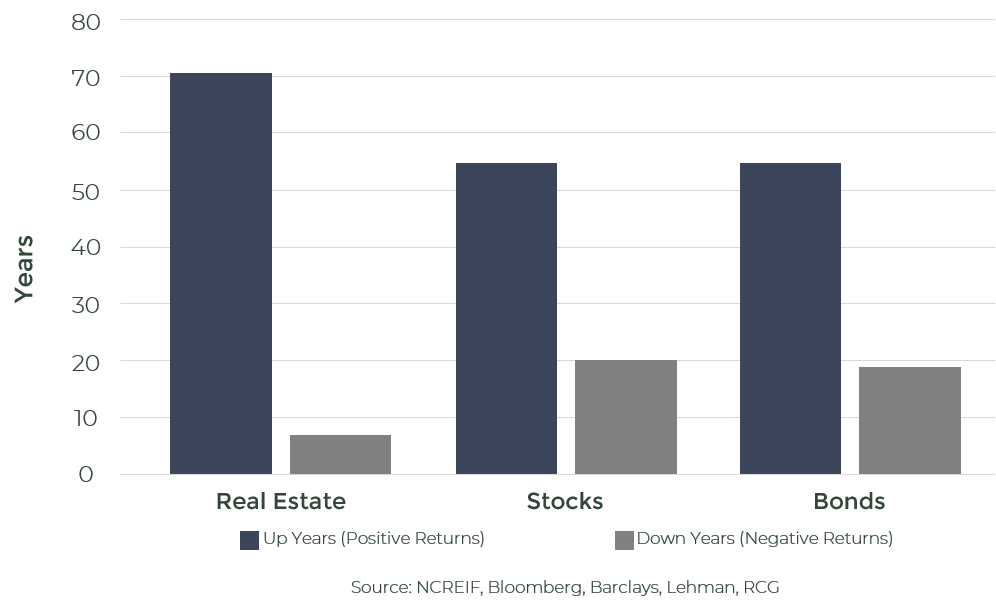

Investing in apartments provides lower risk and better returns than stocks and bonds.

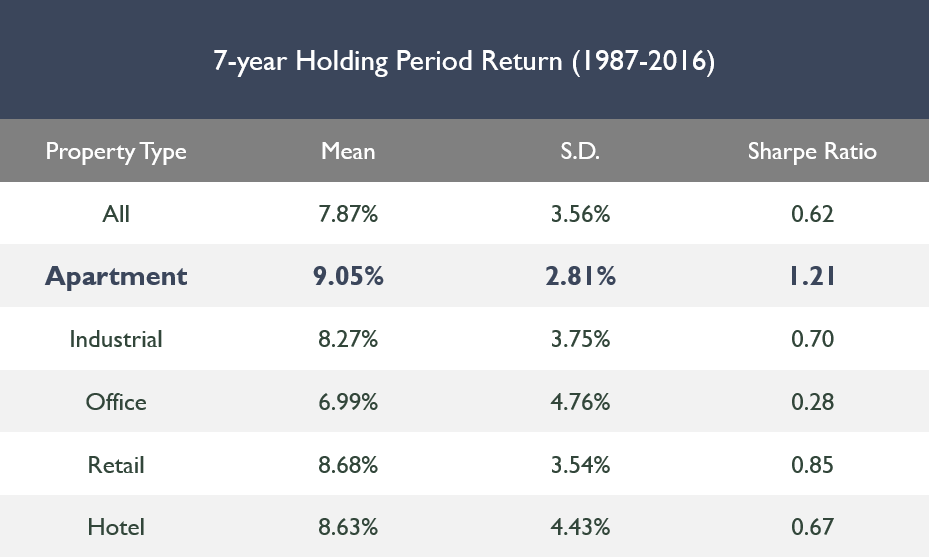

Apartment Investing Provides Higher Returns Than Other Real Estate Asset Classes

Investing in multifamily assets allows for better returns than any other real estate asset class. The National Multifamily Housing Council (NMHC) presented the research on why multifamily investing returns can’t be beat.

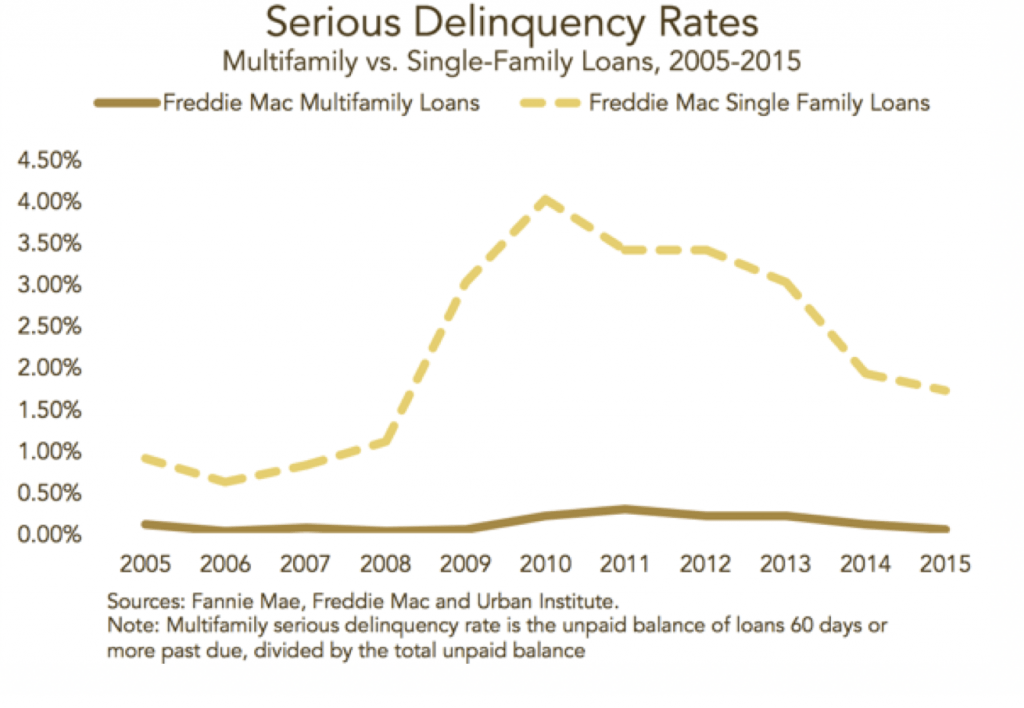

Multifamily Investing Provides Capital Preservation

One of the major benefits of investing in stabilized (above 90% occupancy) multifamily assets, is the ability to use permanent, low risk agency financing. Looking back at the crash in 2008, the single family market had a 4.0% default rate versus the multifamily market only have a 0.4% default rate.

Passive investing in multifamily assets provides lower risk debt which allows for greater capital preservation.

Can Lower Your Taxable Income by Investing in Passive Apartment Syndications

The BluPhoenix Advisors Team only acquires stabilized (above 90% occupancy) and cash flow positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

There are 3 types of depreciation that allow investors to lower taxes:

- Standard or Straight-line Depreciation

- Accelerated Depreciation

- Bonus Depreciation

Cost segregation studies are performed on all of our assets and the tax benefits pass through to our investors via annual year end reporting on K1s that are issued by March 15th for the preceding year.