STRATEGY

The BluPhoenix Advisors' Real Estate Investing Team acquires institutional-quality multifamily assets throughout the United States. We strive to improve our communities through moderate interior and exterior renovations. In addition, our team is experienced in identifying operational inefficiencies which allows us to improve operations to exceed investor expectations.

At Real Estate Investing, We Are Targeting Markets with Strong Apartment Fundamentals and Moderate Cap Rates

Employment Drivers

Strong employment drivers provide stable rental income and lower the risk of the investment by keeping the occupancy rates high.

Supply Constraints

The submarket must have high barriers to entry and a population growth sufficient enough to absorb the schedule future supply of new apartments.

GDP Growth

Being sure to avoid markets nearing a potential bust and that are currently experiencing extremely low cap rates.

MultiFamily Cap Rate Trends

In order to achieve our annual preferred returns for our investors, the economics of the metro area must be very strong.

MultiFamily Rental Trends

Growing rents serve as an important indicator of a healthy and stable economy with lower associated risk of investment.

Multifamily Occupancy Trends

Healthy occupancy rates signal a growing population that is outpacing the current supply of new apartments.

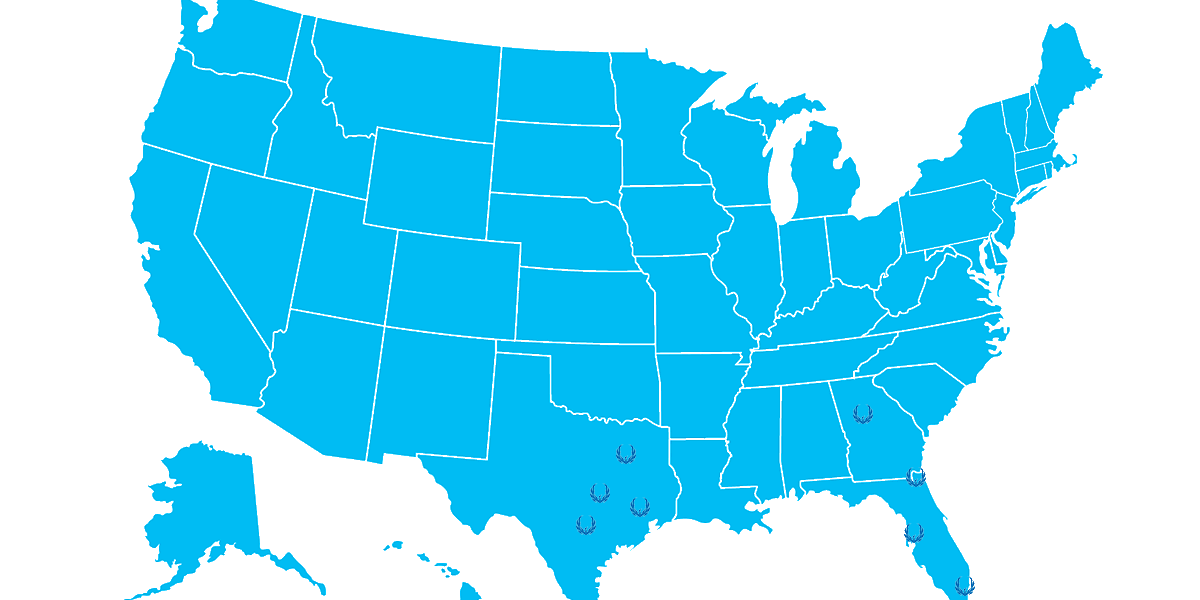

Target Multifamily Markets

Investment Philosophy

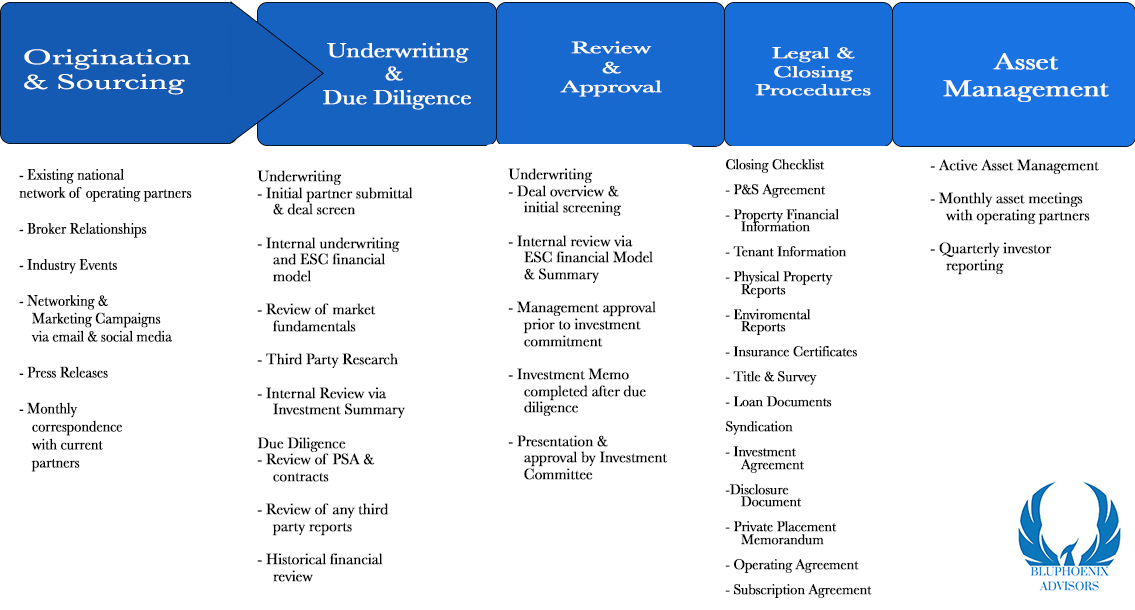

BluPhoenix Advisors is focused on achieving attractive returns for investors while maximizing long-term capital appreciation by investing according to our disciplined strategy of acquiring high-quality real estate investments at an attractive purchase price.

Through an intensive research underwriting process along with our strategic partnerships with experienced operators, BluPhoenix Advisors seeks to foster growth and unlock value across our portfolio by focusing on asset management, property operations, leasing, and targeted value initiatives.

Strategic Partnerships

Invest alongside best in class operators with asset and market expertise

Asset & Market Focus

Invest in high quality assets in markets with attractive demographic fundamentals

Acquisitions Fundamentals

Purchase assets at a discount to replacement cost with in-place income

Active Asset Management

Work with partners to ensure best results for investors

Capital Preservation

Focus on investor capital preservation & growth

Tax Benefits

Levered real estate equity ownership

Risks

Economic Uncertainty

Political / International Risks

Affordability

New Supply

Rent Control

Interest Rate Uncertainty

Mitigant

Market Demographics

Geographic Focus

Purchase at a Steep Discount to Replacement Cost

High Barrier to Entry Markets w/ In-Place Income

Avoid Markets with Significant Rent Control Laws

Banking Relationships, Long Term Debt, Fixed Rate, Hedges

Opportunities

Strong Demographics

Consistent Job / Wage Growth

Strong Demand / Absorption

High Construction Costs

Purchase Below Replacement Cost

Significant Tax Benefits

Best in Class Sponsor Relationships